The Mirage of Money Pyramids: Why They’re a Risky Bet

The allure of easy money, especially in a challenging economy, can be almost irresistible. Money pyramids, also known as Ponzi schemes, often dangle the promise of unrealistically high returns on investments. While the premise sounds tempting, the reality is starkly different, and the consequences dire.

Understanding Money Pyramids

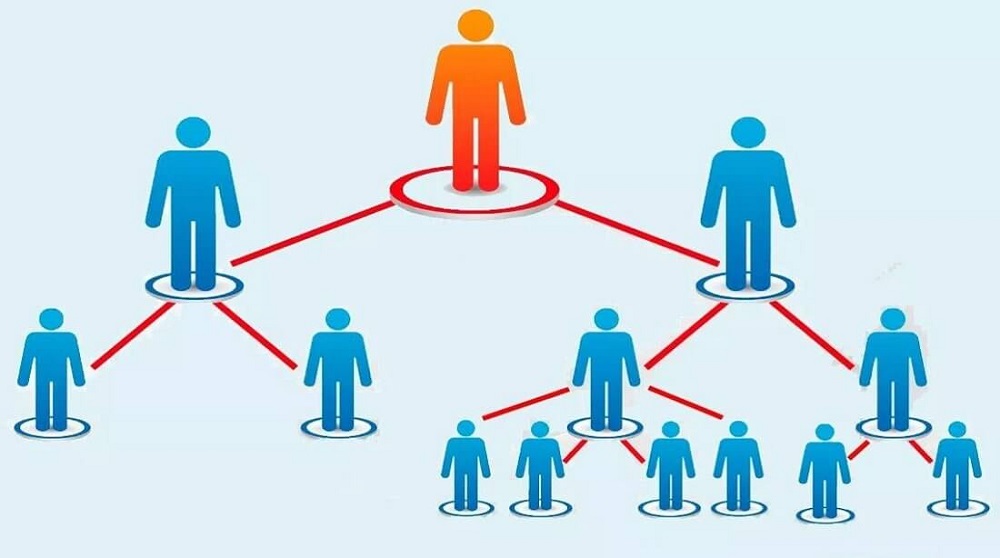

At its core, a money pyramid is based on the principle of robbing Peter to pay Paul. Early investors are paid using the capital of newer participants. It’s a continuous cycle where returns to earlier participants are wholly dependent on finding more people to join. While the structure might seem sustainable, it’s fundamentally flawed.

The system’s inherent instability becomes evident when new entrants dwindle. Without fresh investments, payouts stall, leading to the inevitable collapse of the pyramid.

The Illusion of Profit

Money pyramids thrive on the illusion of profit. Initial investors might see genuine returns, which lends credibility to the scheme. These early success stories are paraded to entice more participants. The catch, however, is that these profits aren’t a result of savvy investment strategies, but merely a redistribution of funds.

As more people join, the base of the pyramid widens, creating the need for an ever-increasing number of participants to sustain payouts. It’s a ticking time bomb of financial deceit.

Consequences of Investment

When money pyramids collapse, the consequences are widespread. The majority of participants end up losing their investments. The fallout isn’t limited to financial losses; the emotional and psychological impact can be profound. Trust is betrayed, and for many, life savings are wiped out.

Legal ramifications are another consideration. While orchestrators of these schemes face severe penalties, participants, especially those who’ve recruited others, might find themselves in legal crosshairs.

Recovery of lost funds is rare. Once the pyramid crumbles, the money is typically scattered, with little left to distribute among the victims.

Red Flags: Spotting a Pyramid

Protecting oneself requires vigilance and an understanding of common red flags associated with money pyramids. Unrealistically high returns are a telltale sign. If an investment opportunity sounds too good to be true, it probably is.

Additionally, if returns are primarily based on recruitment rather than genuine investment strategies, it’s a clear indication of a pyramid structure. Transparency is another factor. Legitimate investments operate with a degree of openness, while Ponzi schemes are shrouded in secrecy.

Making Informed Choices

Financial literacy is the first line of defense against fraudulent schemes. Taking the time to understand the intricacies of an investment opportunity is essential. It’s also crucial to remember that all investments come with risks. However, the risks associated with legitimate opportunities are vastly different from the guaranteed failure of a money pyramid.

Seeking advice from trusted financial advisors and doing due diligence can safeguard one’s hard-earned money from the clutches of unscrupulous opportunists.